About Us

42+

Years Experience

St. John’s Cooperative Credit Union

Our History

Join our growing family and experience the benefits!

St. John’s Cooperative Credit Union (SJCCU) has been serving the public of Antigua & Barbuda since August 16, 1982 when the then Registrar of Cooperatives, Mr. George Jonas, presented the certificate of Registration to the first 16 members. According to our first President, Ms Althea Crick, St. John’s Cooperative Credit Union was born out of a desire to have a model for a modern credit union development. Most of the credit unions that existed in Antigua & Barbuda up to 1982 were closed bond, whereby credit union services were offered exclusively to persons who shared a particular occupation or religion. SJCCU became the first open bond Credit Union to be formed to cater to the needs of everyone.

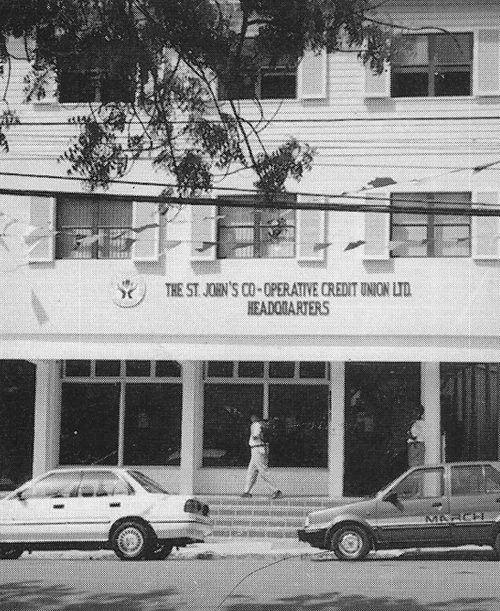

We came from humble beginnings. With the support of the Caribbean Confederation of Credit Unions, St. John’s Cooperative Credit Union was initially hosted by the Credit Union League office, the umbrella organisation for cooperatives in Antigua & Barbuda. The Credit Union League’s office was initially located upstairs Daniel’s Bakery on South Street and later relocated to the former Hitachi building on Tanner Street. In 1992, just ten (10) years later, SJCCU became the proud owners of our own premises the renowned blue and green headquarters, on lower All Saints Road.

After 36 years

Now

After 40 years of strategic planning

SJCCU has flourished into a premier financial institution. Our group of dynamic staff and volunteers continually introduce new and innovative ways to satisfy our members’ evolving needs. We now offer a plethora of savings, lending products as well as services that have become essential to our members, including 24-hour online and ATM access. In 2018, we recorded our highest rate of member growth in our history with 1,365 new members, and experienced tremendous financial growth, profitability and solvency. The Credit Union currently has assets totalling $100M, savings of $89M and loans of $85M. SJCCU’s financial performance is impressive, registering surplus of $1M over the last four consecutive financial years. To better serve our growing credit union family, our branch located at Mandolin Place mall on Friars Hill Road, opened its doors on 22nd January 2018.

St. John’s Cooperative Credit Union was founded on a commitment to empowering our members with the skills to make sound financial decisions. We continue to improve the quality of life of our members – Saving Together for Financial Self-Sufficiency.

42+

Years Experiance

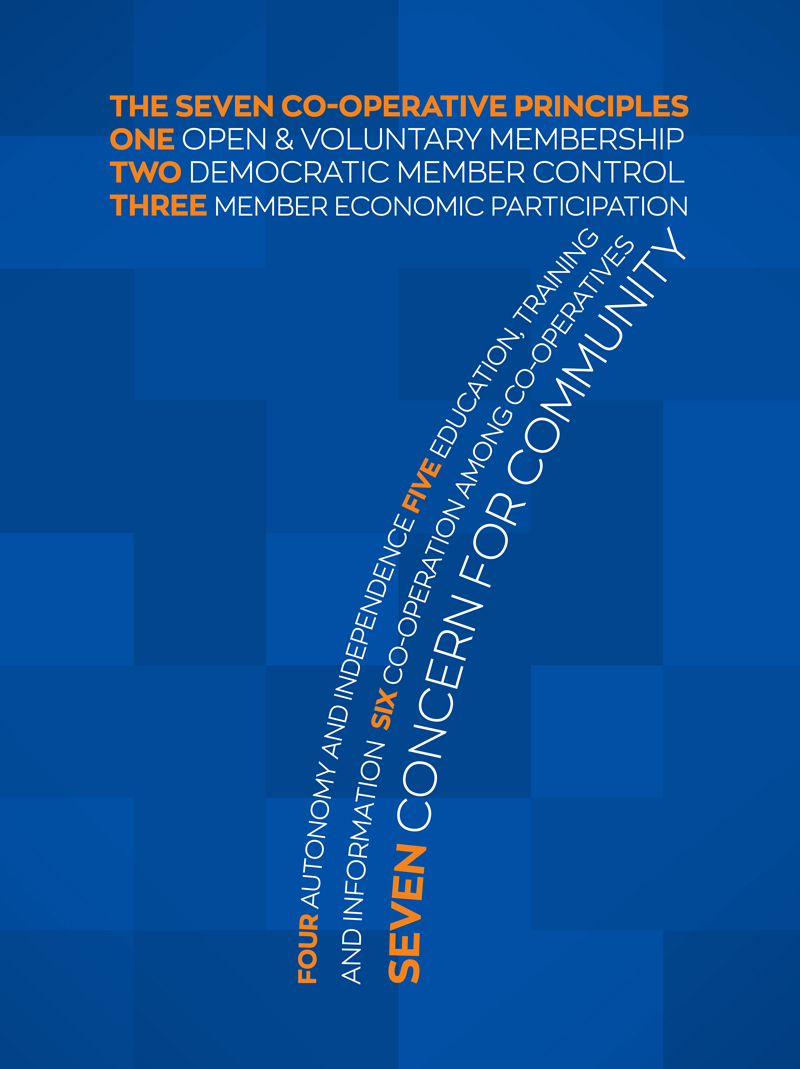

Principles

Voluntary and Open Membership

Voluntary and open membership to persons willing to accept the responsibilities and benefits without gender, social, racial, political, or religious discrimination.Democratic Member Control

Democratic Member Control, which means owned and controlled by their members who have equal voting rights “one member one vote”.Members Economic Participation

Member Economic Participation allows them to equitably contribute to, and manage the capital of the cooperative.Autonomy and Independence

Autonomy and Independence are maintained if an agreement is entered into with another organization.Education, Training and Information

Education, Training and Information are provided for the members so they can effectively contribute to the development of their cooperative.Cooperation among Cooperatives

Cooperation among cooperatives is necessary for the strengthening of the movement locally, nationally, regionally, and internationally.Concern for Community

Concern for Community through sustainable development of the community, facilitated by policies approved by its members.

our testimonials

What they’re saying about

our company

John Anderson

CFO, Anderson Enterprises

Choosing SJCCU for our corporate banking needs was a strategic decision. The corporate office at Friars Hill Branch ensures discreet transactions, and their competitive rates on loans have significantly contributed to our financial stability. SJCCU is a true ally in our financial journey.

Sarah Adams

President, Adams Community Foundation

SJCCU's dedication to community support aligns perfectly with our foundation's mission. Their commitment to local groups and associations is commendable. It's more than just banking; it's a partnership in community development.

Michelle Rodriguez

Owner, Rodriguez Boutique

As a small business owner, SJCCU has been instrumental in my growth. The tailored financial solutions and support have allowed me to expand my boutique. The convenience of their services, from night deposits to digital advertising, sets them apart.

Loans Approved

Happy Members

Expert Staff

Save & Invest

Our Mission and Vision

- Motto

- Mission

- Vision

Saving Together For Financial Self-sufficiency.

To enhance the quality of life of our members and their families by operating an efficient, financially sound and sustainable credit Union that provides affordable and innovative products and services.

To be the premier financial institution in Antigua and Barbuda that is renowned for enhancing the quality of life of its members, their families, communities, and nation.

- Motto

- Mission

- Vision

Saving Together For Financial Self-sufficiency.

- Low minimum deposit of $1,000.00

- Interest paid at maturity

- Minimum deposit term of 1 year

- Can be used as collateral for loan services

To enhance the quality of life of our members and their families by operating an efficient, financially sound and sustainable credit Union that provides affordable and innovative products and services.

To be the premier financial institution in Antigua and Barbuda that is renowned for enhancing the quality of life of its members, their families, communities, and nation.

Your Trusted Partner in Financial Well-Being: A premier, family-oriented credit union dedicated to serving members and the community through cutting-edge products and services.

Copyright © ST. JOHN'S CO-OPERATIVE CREDIT UNION 2023